The share prices of Reliance Power, a company associated with Anil Ambani, have increased by 5% to Rs 23.83. Reliance Power has settled the debt of ICICI Bank, Axis Bank and DBS Bank.

1. Debt Settlement

Reliance Power has successfully repaid its loans to ICICI Bank, Axis Bank and DBS Bank. This development had a significant impact on the company’s shares and the shares rose by 5% to Rs 23.83. Due to this positive news the stock has increased by more than 20% in the last five days.

2. Unprecedented growth of Reliance Power

Over the last four years, Reliance Power shares have shown extraordinary growth, skyrocketing by almost 2000%. From a price of Rs 1.13 in March 2020, the shares have climbed to Rs 23.83 in March 2024. In the last year alone, there has been an increase of approximately 130%. However, it is important to note that the company’s 52-week high and low are Rs 33.10 and Rs 9.05 respectively.

3. Debt settlement of Reliance Infrastructure

Reliance Power’s parent company, Reliance Infrastructure, is also on track to settle its dues of Rs 2,100 crore with JC Flowers Asset Reconstruction Company. The move pushed Reliance Infrastructure shares up 2% to Rs 248.10 on Wednesday. The company’s shares have increased by approximately 2550% in the last four years.

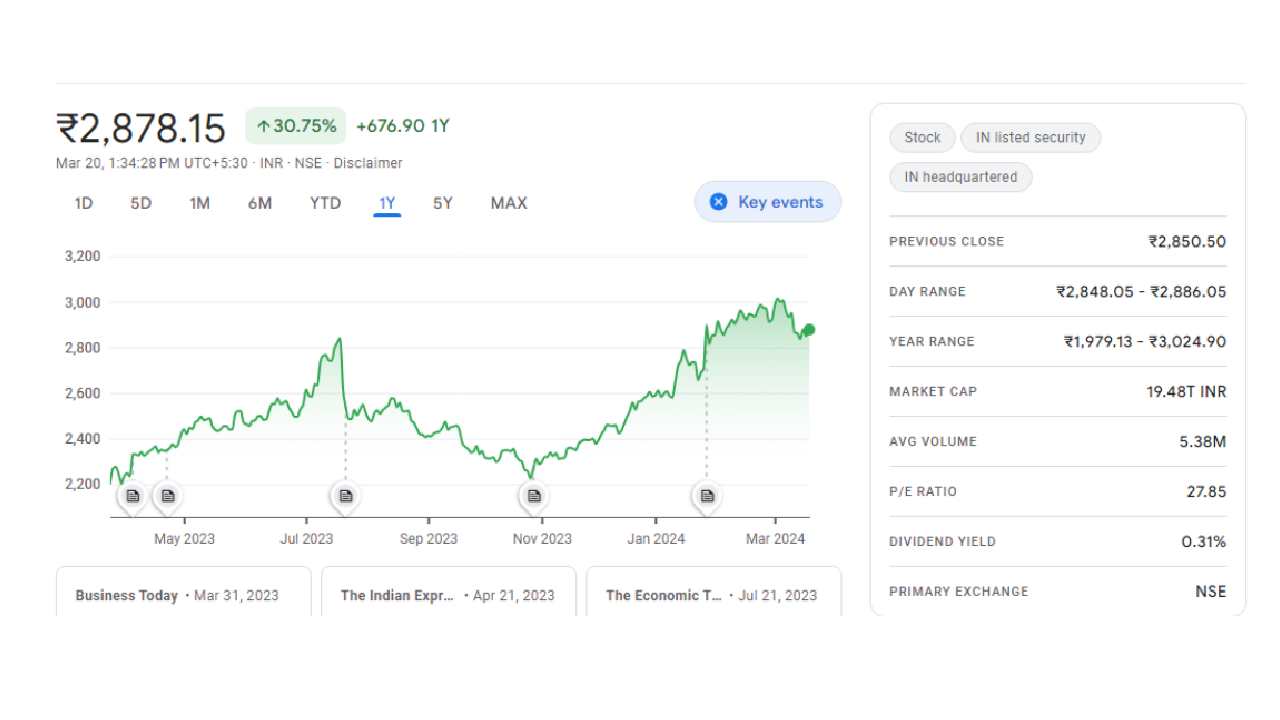

Concerns about IREDA

On the other hand, Indian Renewable Energy Development Agency (IREDA) faced setbacks as the National Stock Exchange (NSE) canceled its inclusion in six indices including the Nifty 500. The decision came after allegations of violation of SEBI portfolio norms. As a result, IREDA shares fell 3% to Rs 124.50.

Expert Insights

According to Rajesh Bhosale of Angel One, despite a strong start and significant price growth, IREDA has seen a significant decline in recent months, with prices falling by more than 50%. The lack of volume activity makes predicting future targets complicated.

IREDA’s quarterly performance

IREDA reported 67.15% growth in profit and 44.22% growth in revenue for the quarter ended December (Q3FY24) compared to the previous year. This positive performance follows the company’s IPO launch last year, which saw a listing premium of 56.25%.

In conclusion, while Reliance Power’s debt repayments boost its stock performance, IREDA challenges underline the volatility in the market. Investors should remain informed and cautious amid these fluctuations.

Also Read – Royal Sense IPO: Spectacular Listing on Stock Market